Distribution of Profit and Losses in Partnership Examples: When there is a change in the profit sharing ratio among the partners then all the accumulated profits and reserves are distributed between them in the old ratio. This is done, because at present the partners share their profits or losses in old profit sharing ratio whereas in future they will be sharing their profits and losses in new profit sharing ratio. Therefore, the gaining partner must compensate the sacrificing partner.

Distribution of Profit and Losses in Partnership Examples 1:

A , B and C are partners sharing profits and losses in the ratio of 1 : 2 : 3 . They decide to share future profits in the ratio of 3 : 2 : 1 .They also decided to record the effect of the following without affecting their book values.

General reserve = 90000 Rs.

Profit and loss A/c(cr) = 30000 Rs.

Advertisement Suspense(Dr) = 60000 Rs.

The single adjusting entry will be:

Explanation : –

Calculation of net effect of reserves and accumulated profits/losses

General reserve = 90000 Rs.

(+) Profit and loss A/c(cr) = 30000 Rs.

(-) Advertisement Suspense(Dr) = -60000 Rs.

Net effect = 60000 Rs.

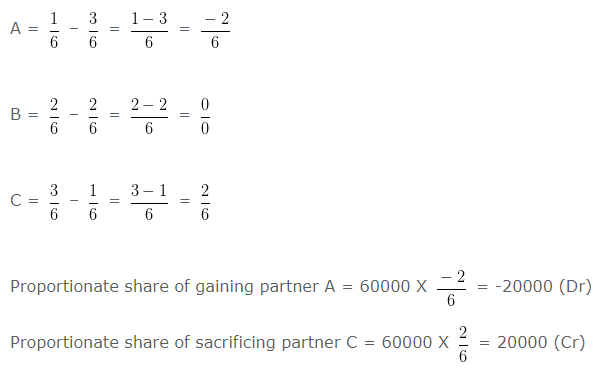

Calculation of sacrificing/gaining share of partners:

Sacrificing ratio = Old share – New share

A s capital A/c Dr 20000

To C s capital A/c 20000

Distribution of Profit and Losses in Partnership Examples 2:

A , D and K are partners sharing profits and losses in the ratio of 6 : 5 : 2 .They decide to share future profits in the ratio of 2 : 5 : 6 .They also decided to record the effect of the following without affecting their book values

Profit and loss A/c(cr) = 65000 Rs.

Advertisement Suspense(Dr) = 13000 Rs.

The single adjusting entry will be:

Explanation : –

Calculation of net effect of reserves and accumulated profits/losses

Profit and loss A/c(cr) = 65000 Rs.

Less: Advertisement Suspense(Dr) = 13000 Rs.

Net effect = 52000 Rs.

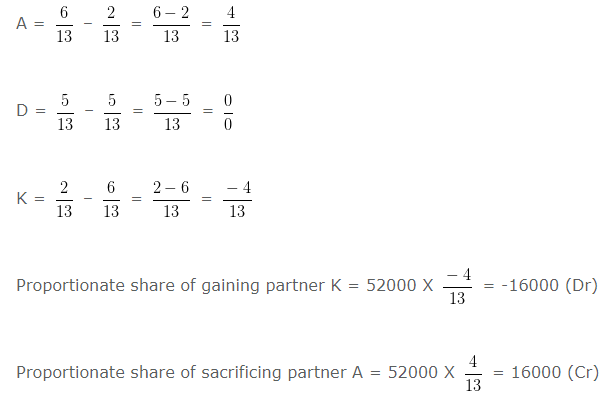

Calculation of sacrificing/gaining share of partners

Sacrificing ratio = Old share – New share

K s capital A/c Dr 16000

To A s capital A/c 16000

Chapter 2 – Accounting for Partnership: Basic Concepts

- Nature of Partnership

- Partnership Deed

- Maintenance of Capital Accounts of Partners

- Distribution of Profit among Partners

- Guarantee of Profit to a Partner

- Past Adjustments