Cash Flow from Investing Activities includes flow of cash which arises due to purchase or sale of fixed assets like land, building, plant & machinery etc. It is an important aspect of growth and capital. It includes only cash transactions and not any credit transactions. Cash flow from investing activities examples are:

- Cash receipts from sale of fixed assets

- Payment made in cash to acquire fixed assets

- Cash advances and loans made to third parties

- Payments made in cash to acquire shares, warrants or debt instruments of other enterprises

- Cash received on account of interests and dividends

- Receipts in cash of insurance claims of third parties

- Cash receipt from sale of fixed assets

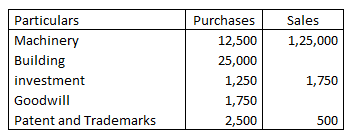

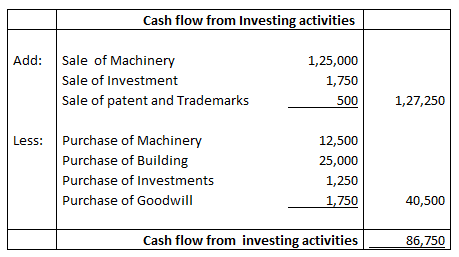

Cash Flow from Investing Activities Example: 1

Following is the information available from the books of Akash Ltd.

Cash flow from investing activities will be:

Explanation : –

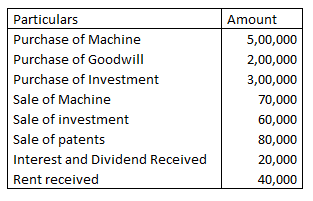

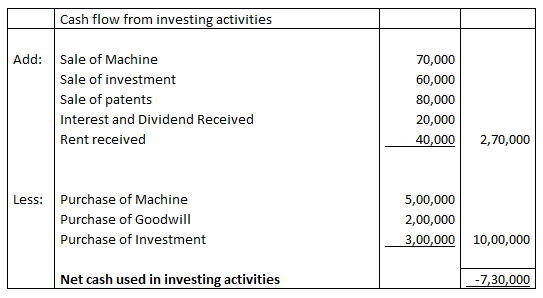

Cash Flow from Investing Activities Example: 2

Cash flow from investing activities from the following information will be:

Explanation : –

Cash Flow from Investing Activities Example: 3

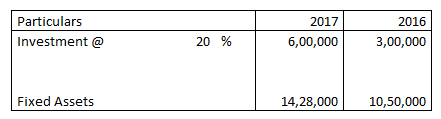

Following is the information available from ABC Ltd

Additional information:

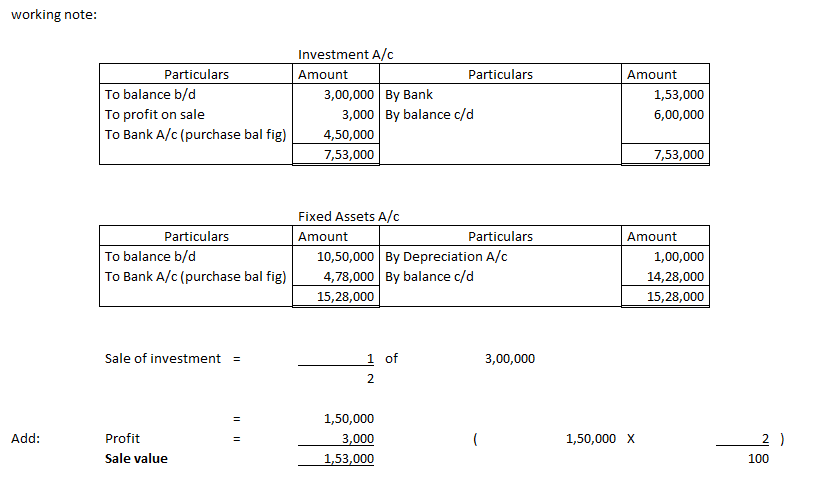

1 Half of the investment held in the beginning of the year was sold at a profit of 2 %.

2 Depreciation on fixed Assets was Rs 100000 for the year

3 Interest received on investment was Rs 90000

4 Dividend received on investment Rs 70000

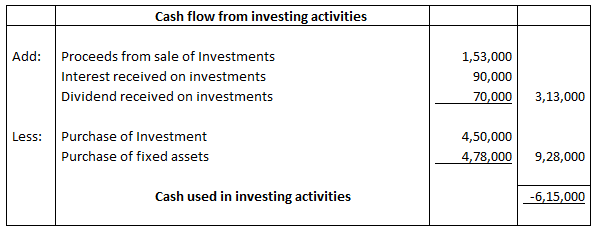

Cash flow from Investing activities will be:

Explanation : –

Cash Flow from Investing Activities Example: 4

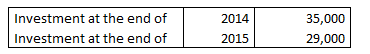

AB Ltd had the following balances

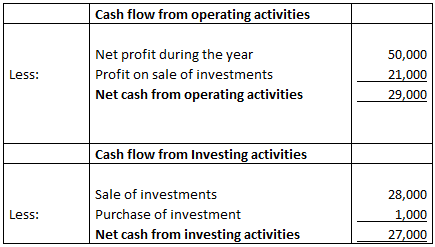

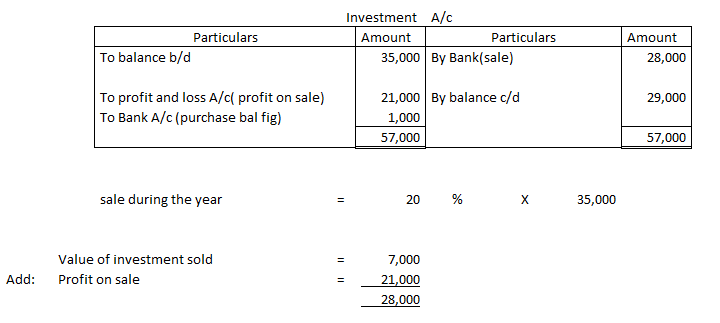

During the year, the company had sold 20 % of its investment at a profit of Rs 21000 .Calculate cash flow from operating activity and cash flow from investing activity if company earned a profit of Rs 50000 during the year will be:

Explanation : –

Cash Flow from Investing Activities Example: 5

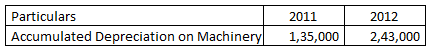

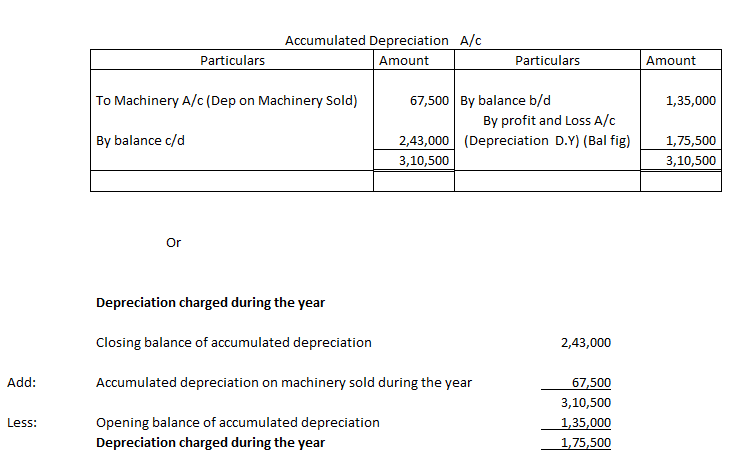

Following is the information relating to Akash Ltd

During the year a Machine sold for Rs 45000 On which Accumulated depreciation was Rs 67500 .

Depreciation charged on machinery during the year is:

Explanation : –

Cash Flow from Investing Activities Example: 6

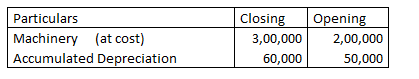

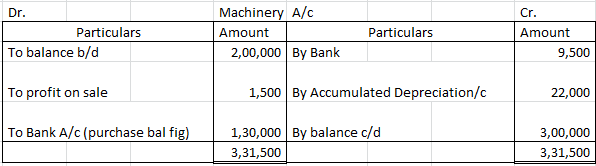

From the following information what will be the amount of asset purchased during the year

Additional information

1 During the year a machine costing Rs 30000 accumulated deprecation Rs 22000 was sold for Rs 9500

Explanation : –

Learn More..