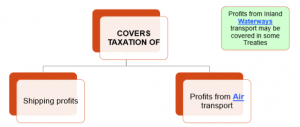

APPLICABILITY OF ARTICLE 8

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

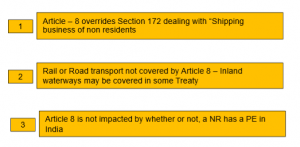

SOME OTHER POINTS OF ARTICLE 8

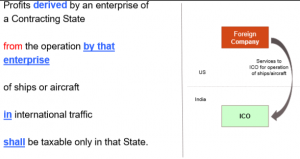

ARTICLE 8(1) – INDIA US TREATY

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 8(1) – INDIA CYPRUS TREATY

Profits derived by

an enterprise registered and having the headquarters (i.e., effective management)

in a Contracting State

from the operation by that enterprise of ships or aircraft in international traffic

shall be taxable only in that State

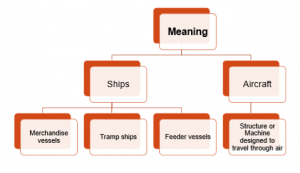

WHAT IS COVERED AS SHIPS & AIRCRAFT

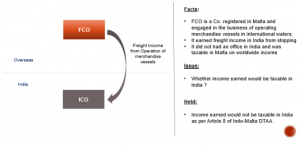

NORASIA CONTAINER LINES LTD. – CASE

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

PLACE OF EFFECTIVE MANAGEMENT (POEM)

APPLICABILITY OF ARTICLE 8A(1)

EXCLUSIONS FROM ARTICLE 8A(1)

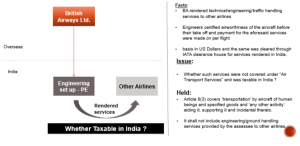

RENDERING ENGINEERING SERVICES TO OTHER AIRLINES– BRITISH AIRWAYS PLC

ARTICLE 8(2) – PROFITS FROM OPERATION OF SHIPS & AIRCRAFTS – INDIA – USA TREATY

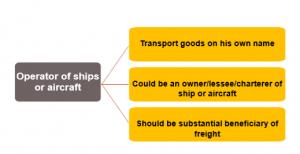

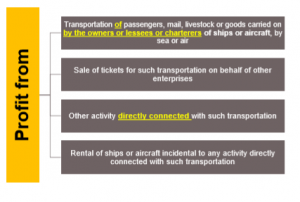

For the purposes of this Article,

profits from the operation of ships or aircraft in international traffic shall mean

profits derived by an enterprise described in paragraph 1

from the transportation by sea or air respectively

of passengers, mail, livestock or goods carried on by the owners or lessees or charterers of ships or aircraft including : –

• the sale of tickets for such transportation on behalf of other enterprises;

• other activity directly connected with such transportation ; and

• the rental of ships or aircraft incidental to any activity directly connected with such transportation.

“PROFIT FROM” IMPLIES

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 9(2) – SHIPPING – INDIA-UK TAX TREATY

1. Income of an enterprise of a Contracting State from the operation of ships in international traffic shall be taxable only in that State.

2. The provisions of paragraph 1 of this Article shall not apply to income from journeys between places which are situated in a Contracting State

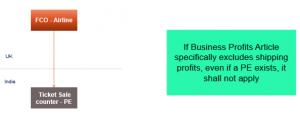

PERMANENT ESTABLISHMENT & ARTICLE 8

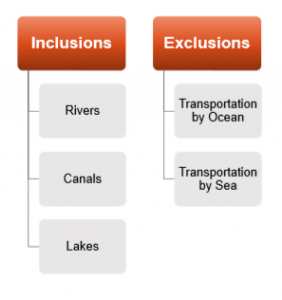

INLAND WATERWAYS TRANSPORT

In certain Treaties, profits from the operation of boats engaged in inland waterways transport may also be covered under Article 8 and are generally taxable only in the Contracting State in which the place of effective management of the enterprise is situated.

MEANING OF INLAND WATERWAYS

ARTICLE 8(3) – INDIA-US TAX TREATY

Profits of an enterprise of a Contracting State described in paragraph 1

from the use, maintenance, or rental of containers (including trailers, barges, and related equipment for the transport of containers)

used in connection with the operation of ships or aircraft in international traffic

shall be taxable only in that State.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

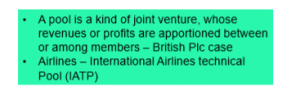

ARTICLE 8(4) – PROFIT FROM PARTICIPATION IN A POOL INDIA-US TAX TREATY

The provisions of paragraphs 1 and 3 shall also apply to

profits from participation in a pool (pools), a joint business, or an international operating agency

ARTICLE 8(5) – INTEREST ON FUNDS CONNECTED WITH OPERATIONS-INDIA-US TAX TREATY

For the purposes of this Article,

interest on funds connected with the operation of ships or aircraft in international traffic

shall be regarded as profits derived from the operation of such ships or aircraft,

and the provisions of Article 11 (Interest) shall not apply in relation to such interest.

INCLUSION/ EXCLUSIONS FROM ARTICLE 8(5)

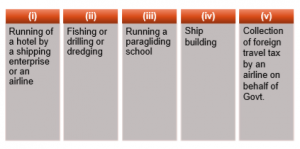

ACTIVITIES COVERED BY ARTICLE 8

EXCLUSIONS FROM ARTICLE 8

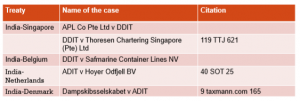

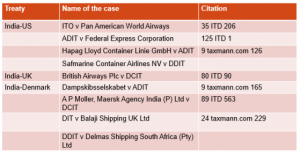

TREATY AND CASE LAWS

TREATY AND CASE LAWS