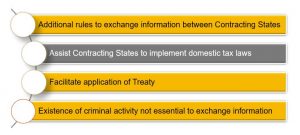

SCOPE

ARTICLE 28(1) OF INDIA USA TREATY – OBLIGATION TO EXCHANGE INFORMATION

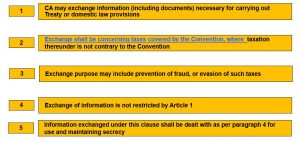

The competent authorities of the Contracting State shall exchange such information (including documents)

as is necessary for carrying out the provisions of this Convention or

of the domestic laws of the Contracting States

concerning taxes covered by the Convention insofar as the taxation thereunder is not contrary to the Convention,

in particular, for the prevention of fraud or evasion, of such taxes.

The exchange of information is not restricted by Article 1 (General Scope).

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

CHARACTERSTICS – ARTICLE 28 (1)

ARTICLE 28(1) OF THE INDIA USA TREATY – USE AND SECRECY OF INFORMATION

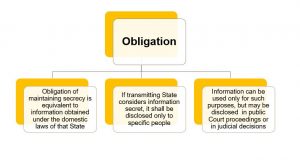

Any information received by a Contracting State shall be treated as secret

in the same manner

as information obtained under the domestic laws of that State.

However, if the information is originally regarded as secret in the transmitting State, it shall be disclosed only to persons or authorities (including Courts and administrative bodies) involved in the assessment, collection, or administration of, the enforcement or prosecution in respect of or the determination of appeals in relation to, the taxes which are the subject of the Convention.

Such persons or authorities shall use the information only for such purposes but may disclose the information in public Court proceedings or in judicial decisions.

The competent authorities shall, through consultation, develop appropriate conditions, methods and techniques concerning the matters in respect of which such exchange of information shall be made, including, where appropriate, exchange of information regarding tax avoidance.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

INFORMATION – SECRECY AND PURPOSE OF USE

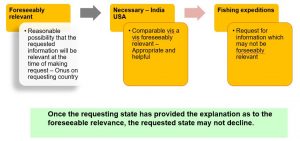

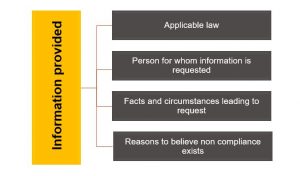

NATURE OF REQUESTED INFORMATION

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

DOES NOT CONSTITUTE A FISHING EXPEDITION IF

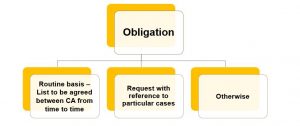

ARTICLE 28(2) OF THE INDIA USA TREATY – FREQUENCY OF EXCHANGE

The exchange of information or documents shall be

either on a routine basis or

on request with reference to particular cases or otherwise.

The competent authorities of the Contracting States shall agree from time to time on

the list of information or documents which shall be furnished on a routine basis.

FREQUENCY OF EXCHANGE OF INFORMATION AND DOCUMENTS

INFORMATION DISCLOSURE

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

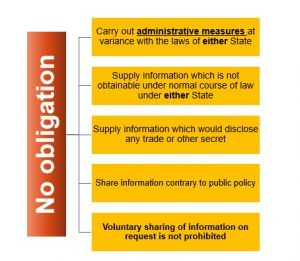

ARTICLE 28(3) OF THE INDIA USA TREATY – NO OBLIGATION OF REQUESTED STATE

In no case shall the provisions of paragraph 1 be construed so as to impose on a Contracting State the obligation :

a.To carry out administrative measures at variance with the laws and administrative practice of that or of the other Contracting State;

b.to supply information which is not obtainable under the laws or in the normal course of the administration of that or of the other Contracting State;

c.to supply information which would disclose any trade, business, industrial, commercial, or professional secret or trade process, or information the disclosure of which would be contrary to public policy (ordre public).

CONTRACTING STATE NOT OBLIGED TO

ARTICLE 28(4) OF THE INDIA USA TREATY

If information is requested by a Contracting State in accordance with this Article,

the other Contracting State shall obtain the information to which the request relates in the same manner and in the same form as if the tax of the first-mentioned State were the tax of that other State and were being imposed by that other State.

if specifically requested by the competent authority of a Contracting State, the competent authority of the other Contracting State shall provide information under this Article in the form of depositions of witnesses and authenticated copies of unedited original documents (including books, papers, statements, records accounts and writings),

to the same extent such depositions and documents can be obtained under the laws and administrative practices of that other State with respect to its own taxes.

ARTICLE 28(5) OF THE INDIA USA TREATY – TAXES COVERED UNDER ARTICLE

For the purposes of this Article, the Convention shall apply, notwithstanding the provisions of Article 2 (Taxes Covered) : –

a. in the United States, to all taxes imposed under Title 26 of the United States Code; and

b. in India, to the income-tax, the wealth-tax and the gift-tax.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

DECLINE INFORMATION RELATING TO BANKING